How to apply for a digital-only loan: understanding the process requirements and advantages

In today’s digital era, obtaining a loan has never been easier, thanks to the rise of digital-only loans. While these online lending options offer a streamlined and efficient application process, understanding how to apply for a digital-only loan can still feel overwhelming. Many potential borrowers are unsure about the steps involved in securing a loan entirely online. This article serves as a comprehensive guide to help you navigate the process of applying for a digital-only loan, ensuring that you feel confident and prepared every step of the way.

In this guide, we will cover:

- Thorough Research: Learn how to select the right online lender and compare various digital loan options.

- Required Documentation: Understand what personal and financial information you’ll need to provide during the online loan application.

- Credit Considerations: Discover how your credit score affects loan terms and approval in the digital lending space.

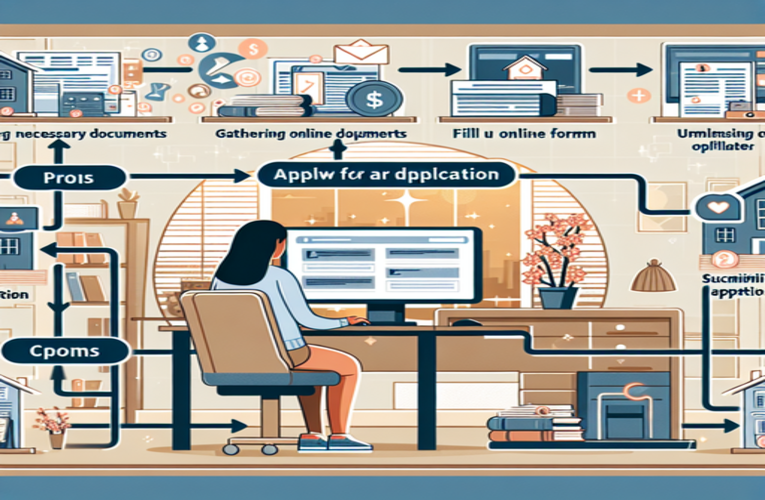

- The Application Process: Step-by-step instructions on how to successfully apply for a digital-only loan online.

- Evaluating Costs: Compare digital-only loans to traditional loans, focusing on their unique benefits and potential drawbacks.

By the end of this article, you’ll not only grasp the requirements and steps to apply for a digital-only loan but also better understand how to optimize your online borrowing experience to meet your financial needs. Whether you’re considering an online loan for debt consolidation, home improvements, or unexpected expenses, this guide will equip you with the knowledge necessary for making informed decisions in the digital lending world.

Table of Contents

How to Apply for a Digital-Only Loan: A Comprehensive Guide

Applying for a digital-only loan might seem overwhelming initially; however, the process is often simpler and more efficient than expected. This extensive guide will walk you through each step involved in applying for an online-only loan, ensuring you are thoroughly equipped to navigate the digital loan application process. By understanding the steps to secure a digital-exclusive loan, you can streamline your path to getting approved for the funds you need.

Conduct Thorough Research

Start by exploring various online lenders that provide digital-only loan services, each with specific terms and conditions tailored to different borrower profiles. It’s crucial to compare interest rates, loan amounts, and repayment options before making a decision. For example, some internet-based loan providers may offer competitive rates for excellent credit scores, while others specialize in loans for borrowers with less-than-perfect credit. Typical loan amounts range from $1,000 to $100,000, catering to a wide array of financial needs, whether you’re looking to consolidate debt, finance a major purchase, or cover unexpected expenses.

- Lenders: Explore different digital lending platforms, such as peer-to-peer lenders, fintech companies, and traditional banks offering online services.

- Compare Rates: Check annual percentage rates (APRs), loan amounts, repayment terms, and any additional fees like origination or application fees.

- Read Reviews: Look for customer feedback and ratings to gauge lender reliability and customer service quality.

- Prequalification Options: Utilize prequalification tools to see potential offers without affecting your credit score.

Gather Required Documentation

Once you have selected a suitable lender, it’s time to compile the necessary personal information and documentation required for your digital loan application. Most digital-only lenders necessitate proof of identity, such as a driver’s license, passport, or state-issued ID. Additionally, you’ll need to verify your income, which might involve providing recent pay stubs, W-2 forms, or tax returns, especially if you are self-employed. Details regarding any existing debts, such as other loans or credit card balances, may also be required. Preparing these documents in advance not only streamlines the online loan application process but also demonstrates your readiness and reliability as a borrower. These documents are essential components that help lenders evaluate your creditworthiness effectively and expedite approval.

Key Documents to Prepare

- Proof of Identity: Driver’s license, passport, or government-issued ID.

- Proof of Income: Recent pay stubs, W-2 forms, 1099 forms, or tax returns.

- Employment Verification: Contact information for your employer or employment contract if applicable.

- Bank Statements: Recent statements to verify financial stability.

- Debt Information: Details of existing loans, credit cards, and other financial obligations.

Understand Credit Considerations

Your credit score plays a significant role in the loan approval process, especially when applying for a digital-only loan. A stronger credit profile is typically associated with more favorable loan terms and lower APRs, which can range widely—from approximately 6.99% for excellent credit to as high as 35.99% for lower credit scores. Before applying, it’s advisable to check your credit report from the major credit bureaus—Equifax, Experian, and TransUnion—to understand your standing. Addressing any discrepancies, such as errors or outdated information, can improve your credit score and enhance your chances of approval. Simple actions like reducing outstanding debts, making timely payments, and limiting new credit inquiries can positively impact your credit profile over time. Understanding the impact of your credit score on digital loan approval can help you strategize and potentially qualify for better rates and terms.

Credit Score Ranges and Their Impact

| Credit Score Range | Rating | Potential APR Range |

|---|---|---|

| 800-850 | Exceptional | 6.99% – 9.99% |

| 740-799 | Very Good | 10.00% – 12.99% |

| 670-739 | Good | 13.00% – 19.99% |

| 580-669 | Fair | 20.00% – 29.99% |

| 300-579 | Poor | 30.00% – 35.99% |

Understanding where your credit score falls within these ranges can help you anticipate the loan terms you might qualify for. If your score is in the lower ranges, you might consider steps to improve your credit before applying, or seek out lenders that specialize in loans for borrowers with less-than-perfect credit. Additionally, some digital lenders offer prequalification processes with soft credit checks, allowing you to see potential offers without affecting your credit score.

Initiate the Application Process

Once you’re prepared, navigate to the lender’s official website and locate the digital loan application section. Most platforms make this prominent and user-friendly. When filling out the online form, ensure you provide accurate and comprehensive information regarding your personal details, employment status, and financial status. This includes the desired loan amount and its intended purpose—whether for debt consolidation, medical expenses, home improvements, education expenses, or other personal needs. Being transparent about the loan’s purpose can sometimes improve your approval chances and may affect the terms offered. Before submitting, carefully review all the information for accuracy to avoid delays or potential rejection. Scrutinize the loan terms closely, paying particular attention to the APR, any origination fees—which can range from 0% to 9%—and any charges related to early repayment or late payments. Understanding these terms upfront can help you avoid unexpected costs and choose the most affordable loan option.

Tips for a Successful Application

- Double-Check Information: Ensure all personal and financial details are accurate.

- Be Honest: Providing false information can lead to rejection or legal consequences.

- Use Secure Connections: Apply from a secure internet connection to protect your data.

- Read the Privacy Policy: Understand how your personal information will be used and protected.

- Save or Print Confirmation: Keep a record of your application submission for future reference.

Monitor Your Application Status

After submitting your application, it’s important to monitor your application status closely. The lender will review your credit profile, employment history, and other relevant information to assess your eligibility. You may receive requests for additional documents or clarifications—responding promptly can expedite the process. Processing times vary by lender; however, many digital lenders leverage automated systems to provide quick decisions. If all criteria are met, you may receive a loan offer within minutes to a few hours. For instance, some lenders offer instant approval with conditional offers, pending verification of your information. To facilitate swift funding, sign the promissory note electronically as soon as you accept the loan terms. Some lenders may have cut-off times—for example, signing before 1 PM ET on a business day could potentially result in the funds being deposited into your bank account within one business day. Keep in mind that bank processing times can affect when the funds become available.

What to Do If Your Application Is Denied

If your application is denied, don’t be discouraged. Lenders are required to provide an adverse action notice explaining the reasons for denial. Common reasons include low credit score, insufficient income, or high debt-to-income ratio. Review this information to understand what improvements you can make before reapplying. Consider reaching out to the lender for further clarification or advice on how to qualify in the future. Alternatively, you might explore other lenders with more flexible requirements or consider applying with a co-signer to strengthen your application.

Stay Organized and Prepared

To enhance your chances of a successful application and expedite the approval process, it’s essential to stay organized and prepared. Keep all relevant documents, such as identification, income verification, bank statements, and tax returns, in a secure and easily accessible location, whether physical or digital. Create a checklist of required materials to ensure nothing is overlooked. Set reminders for any deadlines or follow-up actions required by the lender. Being proactive allows you to respond promptly to any additional requests for information or clarification, which not only speeds up the process but also demonstrates reliability to the lender. Additionally, maintaining organized financial records can help you better understand your financial situation and provide insights that may be beneficial when negotiating terms or planning repayment.

Utilize Financial Management Tools

Consider using financial management software or apps to track your finances and document collection. Tools like budgeting apps, digital filing systems, and calendar notifications can streamline the process and reduce stress. This level of organization can also be beneficial beyond the loan application, contributing to better financial health in the long term.

Requirements for Digital-Only Loan Applications

When applying for a digital-only loan, understanding the requirements is crucial for streamlining the application process and enhancing approval chances. Here’s a breakdown of essential elements to consider:

Essential Documents

- Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN): Necessary for identity verification and credit checks.

- Proof of Income: Recent pay stubs, W-2s, 1099s, or bank statements showing regular income deposits, especially important for self-employed applicants.

- Proof of Employment: Employer contact information or employment contracts may be required to verify employment status.

- Proof of Residence: Utility bills or lease agreements can serve as proof of address.

- Bank Account Information: Routing and account numbers for the bank account where funds will be deposited and payments will be made from.

Credit Eligibility

- Credit Score: Most lenders prefer a credit score of 660 or higher, but some digital lenders specialize in working with borrowers who have lower scores.

- Debt-to-Income Ratio: A lower ratio indicates a better ability to manage monthly payments and may improve approval chances.

- Credit History Length: A longer credit history can provide more data for the lender to assess your borrowing habits.

- Annual Percentage Rate (APR): Can vary widely, from 6.99% to 35.99%, depending on your credit profile.

- No Recent Bankruptcies or Delinquencies: Some lenders may disqualify applicants with recent negative marks on their credit reports.

Loan Amounts and Origination Fees

| Loan Amount Range | Credit Influence | Origination Fees |

|---|---|---|

| $1,000 – $5,000 | Available to a wide range of credit profiles | 0% – 5% |

| $5,001 – $20,000 | Better rates with good credit scores | 1% – 8% |

| $20,001 – $100,000 | Requires strong creditworthiness | 1% – 10% |

Origination fees are often deducted from the loan proceeds, so plan accordingly. For example, if you are approved for a $10,000 loan with a 5% origination fee, you may receive only $9,500, but you’ll still be responsible for repaying the full $10,000 plus interest. Understanding these fees helps you request the correct loan amount to meet your financial needs after fees.

Residency and Age Requirements

- Residency: Typically limited to U.S. citizens or permanent residents with valid SSN or ITIN.

- Age: Must be at least 18 years old (19 in Alabama and Nebraska, 21 in Mississippi).

- State Regulations: Some states have additional regulations or restrictions on lending practices. For example, residents of Ohio may have specific provisions to consider.

It’s essential to review the lender’s eligibility criteria thoroughly before applying. Some lenders may not operate in certain states due to regulatory constraints. Additionally, military members may be subject to the Military Lending Act, which places restrictions on certain loan terms.

Preparation is key when applying for a digital-only loan. Proper documentation can lead to faster financing options, with funds potentially available on the same business day. This efficiency is beneficial if immediate access to cash is needed for emergencies, medical expenses, or time-sensitive opportunities.

In summary, understanding the requirements for a digital-only loan is essential. By familiarizing yourself with necessary documents, credit eligibility, and lender-specific criteria, you can navigate the lending landscape confidently, ensuring a smooth application experience and maximizing chances for favorable loan terms.

Evaluating Costs and Benefits of Digital-Only Loans vs. Traditional Loans

When considering financing options, thoroughly evaluating the costs and benefits of digital-only loans compared to traditional loans is essential for making an informed choice. Digital-only loans offer distinct advantages, leveraging technology to facilitate the borrowing process, making them appealing to many borrowers who value convenience and speed. Understanding the differences between online-only loans and traditional bank loans can help you decide which option aligns best with your needs.

Benefits of Digital-Only Loans

- Streamlined Application Process: The entire process is conducted online, eliminating the need for in-person visits or extensive paperwork. Many lenders provide same-day funding, which proves invaluable for urgent financial needs.

- Borrowing Range: Amounts typically range from $1,000 to $100,000, with competitive APRs starting as low as 6.99%. This wide range accommodates various financial needs, from small personal expenses to significant investments.

- Lenient Eligibility Requirements: Online lenders frequently accept applicants with a wide range of credit scores, increasing chances for those with less-than-perfect credit histories. Some platforms specialize in loans for individuals with fair or poor credit.

- No Early Payoff Penalties: Various digital-only lenders often do not impose penalties for early repayment, offering borrowers flexibility to pay off their loans sooner and save on interest.

- Transparent Terms: Digital lenders typically provide clear details about loan terms, fees, and repayment schedules upfront, allowing for better financial planning.

- Innovative Features: Some digital lenders offer tools like mobile apps for account management, flexible payment options, or financial education resources.

Costs to Consider

- Origination Fees: These can vary from 0% to 10% of the total loan amount, depending on the lender and your creditworthiness. It’s essential to factor these fees into the total cost of the loan.

- Potentially Higher APRs for Poor Credit: Borrowers with lower credit scores may face higher interest rates compared to those offered by traditional banks to prime borrowers.

- Limited Personal Interaction: The online nature of digital loans means less face-to-face support, which may be a consideration if you prefer in-person assistance.

- Security Concerns: Sharing personal and financial information online necessitates ensuring that the lender uses robust security measures to protect your data.

Comparative Overview

| Aspect | Digital-Only Loans | Traditional Loans |

|---|---|---|

| Application Process | Online, quick, minimal paperwork | In-person or over the phone, more extensive paperwork |

| Funding Speed | Same-day or next-day funding often available | Typically takes several days to weeks |

| APRs | Starts around 6.99%, may be higher for lower credit scores | Varies, sometimes lower for excellent credit |

| Fees | Origination fees 0% – 10%, generally transparent | May have application fees, late fees, potential hidden charges |

| Credit Requirements | Flexible, options for various credit profiles | Typically stricter, favoring borrowers with high credit scores |

| Customer Service | Primarily online support, live chat, email, phone | In-person consultations and support available |

| Convenience | Accessible 24/7 from any location | Limited to bank hours and branch locations |

| Security | Dependent on digital protections and encryption | Traditional security measures, reliance on physical documents |

While considering your options, it is vital to weigh the advantages of quicker funding, competitive rates, and a more user-friendly application process of digital-only loans, alongside potential costs such as origination fees and higher APRs for lower credit scores. Traditional loans may offer lower rates for well-qualified borrowers and the comfort of in-person service, but often come with a lengthier application process and stricter credit requirements.

It is equally important to scrutinize the terms of each loan and reflect on the long-term impact that borrowing will have on your financial landscape. Consider factors such as total repayment cost, monthly payment amounts, and your ability to repay the loan comfortably within the terms provided.

Making the Right Choice

Ultimately, the decision between a digital-only loan and a traditional loan hinges on your individual financial situation, preferences, and priorities. If speed, convenience, and accessibility are paramount, and you’re comfortable with online transactions, a digital-only loan might be the best fit. If you prefer personal interaction and potentially lower rates available to those with excellent credit, a traditional loan could be more suitable.

By taking an informed approach and understanding the nuances of both loan types, you can navigate the lending landscape more effectively. This ensures that you select the loan option that aligns best with your financial goals and needs, empowering you to make choices that will support your financial stability and success.

Summary

- Research Lenders: Compare various online lenders by examining interest rates, loan amounts, and repayment options to understand how to apply for a digital-only loan effectively.

- Gather Documentation: Prepare necessary documents such as proof of identity, income verification, and details about existing debts to streamline your application for an online loan.

- Credit Score Impact: Your credit score significantly influences loan terms; aim for a credit score of 660 or higher to access better options when applying for an online-only loan.

- Application Steps: Complete an online loan application accurately and understand all loan terms, including any origination fees (typically up to 9%) associated with digital lending.

- Monitor Status: After submission, stay updated on your application status, as you could receive a loan offer the same day when applying for a fully digital loan.

- Understand Costs: Evaluate the unique benefits of digital-only loans, including potential same-day funding and lower fees compared to traditional loans, to make informed financial choices.

By following these guidelines on how to apply for a digital-only loan, you can successfully navigate the online loan process, ensuring you make informed financial choices that suit your needs.

Questions and Answers

What are the standard repayment periods for online-only loans?

Repayment schedules for digital-only loans typically span from 1 to 7 years, influenced by the specific lender and the loan amount. It’s crucial to discuss and comprehend the detailed terms provided by your chosen online lender to ensure they align with your financial capabilities.

Can I apply for an online loan with a co-signer?

Yes, many online lenders allow you to apply for digital-only loans with a co-signer. Having a co-signer can enhance your approval chances and potentially secure more favorable loan terms, especially if your co-signer has a stronger credit profile.

Is it possible to get pre-approved for a digital-only loan?

Absolutely, numerous online lenders offer pre-approval options for digital-only loans. This process allows you to view potential loan amounts and terms based on your financial profile without impacting your credit score, serving as a beneficial first step before submitting a full application.

What happens if I miss a payment on my online-only loan?

Missing a payment on a digital-only loan can lead to late fees, an increase in your interest rate, and a negative impact on your credit score. It’s essential to communicate promptly with your online lender if you encounter payment difficulties to explore alternative arrangements.

Are online-only loans available to non-U.S. residents?

Generally, digital-only loans are available to U.S. citizens or permanent residents. However, some online lenders might have specific eligibility requirements for non-residents, so it’s recommended to check directly with the lender to understand their criteria.

How can I improve my chances of approval for an online loan?

Enhancing your credit score, reducing existing debts, and organizing necessary documentation can significantly boost your approval chances for a digital-only loan. Additionally, comparing multiple online lenders can help you find the best options tailored to your financial situation.

Can digital-only loans be used for any purpose?

Yes, digital-only loans are typically versatile and can be used for various purposes such as debt consolidation, medical expenses, home improvements, or personal needs. However, it’s advisable to review the specific terms with your online lender to confirm the acceptable uses for the loan funds.

What fees should I be aware of when applying for an online loan?

Common fees associated with digital-only loans include origination fees, which can range from 0% to 12%, and potential early repayment charges. It’s essential to thoroughly review the terms and conditions provided by your online lender to understand all applicable fees.

How do online lenders evaluate my creditworthiness for a digital-only loan?

Online lenders assess your creditworthiness by reviewing factors such as your credit score, income, existing debt, and overall financial history. They may also examine your payment history and any discrepancies in your credit report to determine your reliability as a borrower.

Is it safe to apply for a digital-only loan online?

Yes, applying for a digital-only loan online is generally safe when you choose reputable lenders that utilize secure websites and encryption technologies. Always verify the lender’s credentials, read customer reviews, and ensure the website has proper security measures in place to protect your personal information.